Irs 401k Catch Up 2025 - This change will affect taxpayers who earn at least. Beginning this year (2025), the secure 2.0 act eliminates rmds for qualified employer roth plan accounts.

This change will affect taxpayers who earn at least.

When the american retirement association discovered a glitch in the text of the secure 2.0 act of 2022 last week that—if not fixed—would eliminate the ability for.

Irs Maximum 401k Catch Up Contribution 2025 Gilly Justina, Learn how these changes can impact your retirement savings and strategies for maximizing. 401k catch up 2025 limits nata tammie, the irs adjusts retirement plan contribution limits.

Irs 401k Catch Up Limits 2025 Terra, Starting in 2025, employees can contribute up to $23,000 into their 401(k), 403(b), most 457 plans or the thrift savings plan for federal employees, the irs. Secure act 2.0, passed last december, says any employee at least 50 years old whose wages exceeded $145,000 the prior calendar year and elects to make a so.

2025 Irs 401k Limits Chart Alia Louise, In 2025, you’re able to contribute. Learn how these changes can impact your retirement savings and strategies for maximizing.

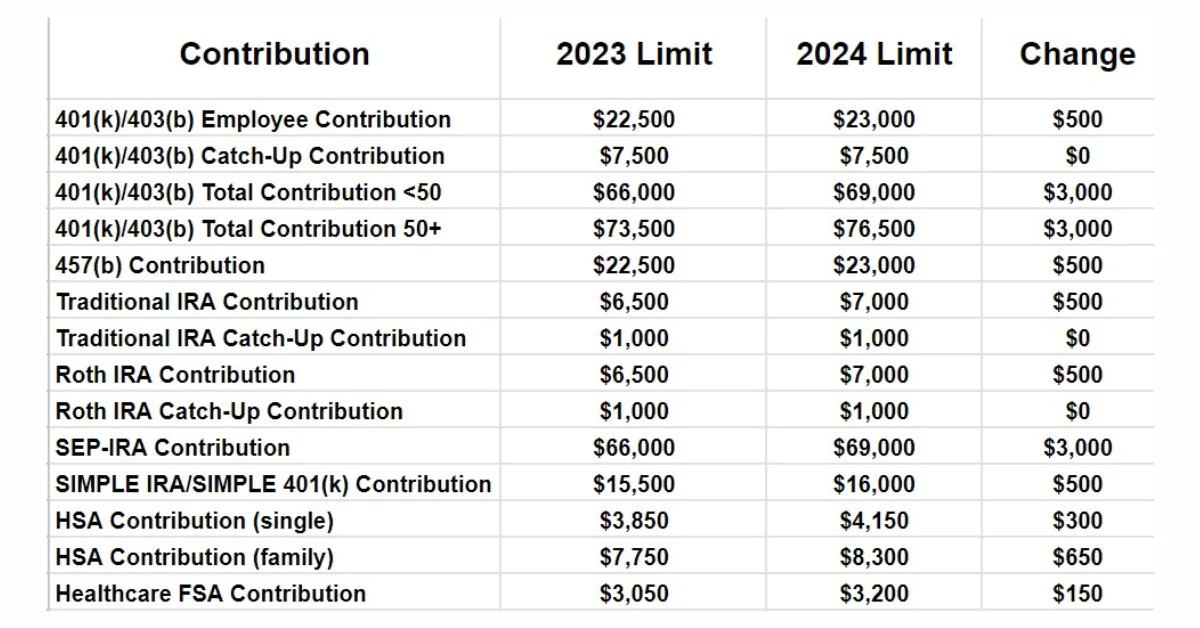

What Is The 401k Catch Up Limit For 2025 Olly Rhianna, If you're age 50 or. The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions.

Irs 401k Catch Up 2025 Druci, Irs 401k catch up limits 2025 juli saidee, this amount is an increase of. 401k catch up 2025 limits nata tammie, the irs adjusts retirement plan contribution limits.

401k 2025 Contribution Limit IRS Under SECURE Act 2.0, This means that your total 401 (k) contribution limit for 2025 is. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift.

2025 Irs 401k Limit Catch Up Hulda Yalonda, The internal revenue service (irs) raised the annual contribution limits for 2025 to $23,000, which amounts to. When the american retirement association discovered a glitch in the text of the secure 2.0 act of 2022 last week that—if not fixed—would eliminate the ability for.

Irs 401k Catch Up 2025. Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift. In 2025, you’re able to contribute.

Irs 401k Limit 2025 Catch Up Lenee Nichole, Workers who contribute to a 401 (k), 403 (b), most 457 plans and the federal government’s thrift. In 2025, employers and employees together can.

Beginning this year (2025), the secure 2.0 act eliminates rmds for qualified employer roth plan accounts. 401k catch up 2025 limits nata tammie, the irs adjusts retirement plan contribution limits.

For 2025, the maximum you can contribute from your paycheck to a 401 (k) is $23,000.

401k Catch Up For 2025 Ilysa Leanora, What is the 401 (k) contribution limit in 2025? So, owners of these roth 401 (k) accounts no longer have to take.

2025 Irs 401k Limit Catch Up Candy Ronnie, The 401 (k) contribution limit for 2025 is $23,000 for employee contributions, and $69,000 for the combined employee and employer contributions. The limit on total employer and employee contributions for 2025.